What Makes VELOCARD Special?

We're not just another card. We're a complete financial platform designed for modern India's unique needs.

Ultimate Flexibility

Reload anytime, set custom limits, and control spending across categories. Your money, your rules.

Military-Grade Security

Bank-level encryption, real-time fraud detection, biometric authentication, and instant card freezing.

AI-Powered Insights

Smart analytics that categorize spending, predict trends, and offer personalized financial advice.

Seamless Integration

Connect with UPI, net banking, wallets, and all major payment platforms across India.

Purpose-Built Design

Each card is engineered for specific demographics with tailored features and benefits.

Complete Ecosystem

From individuals to enterprises, we provide solutions for every financial need in one platform.

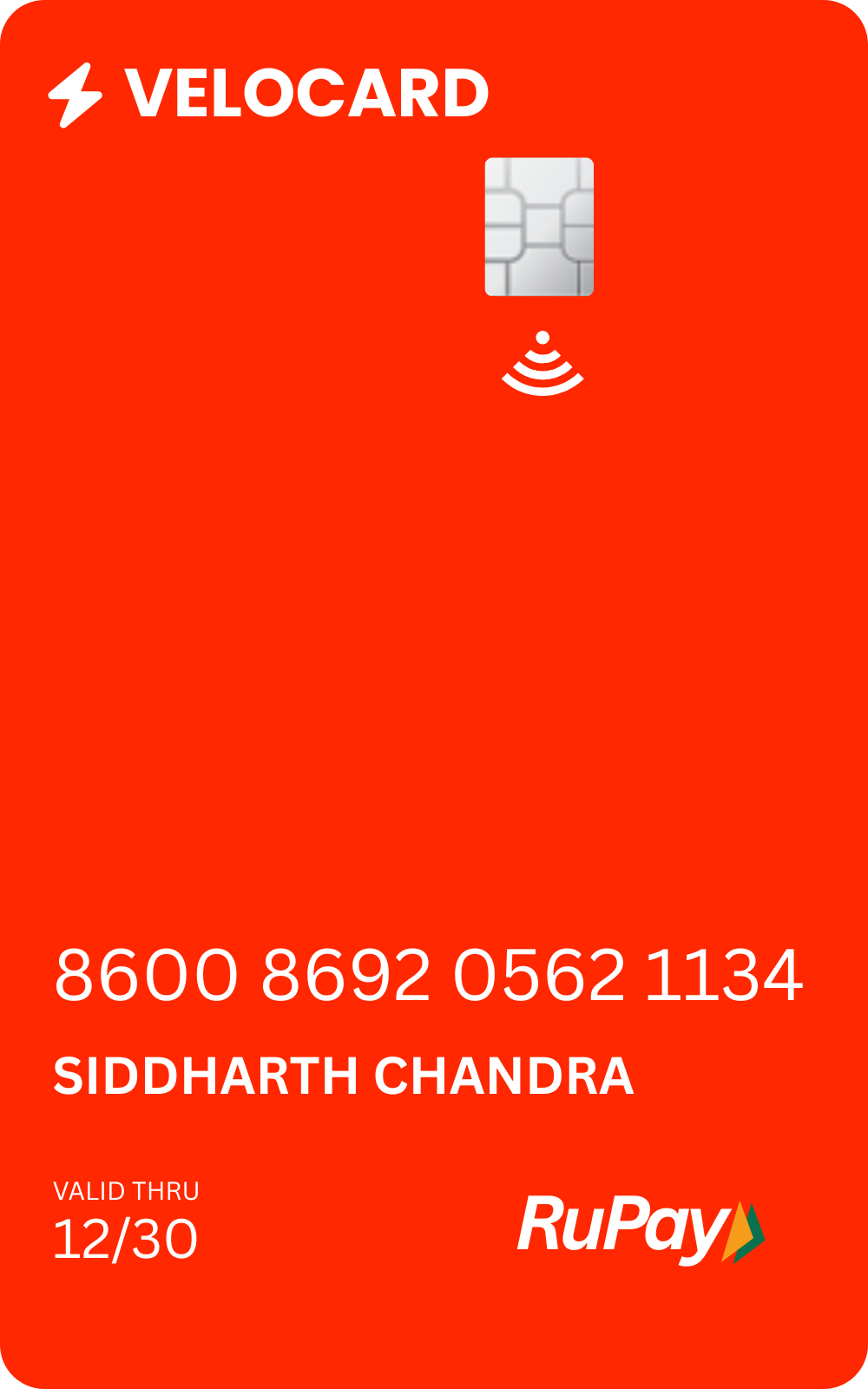

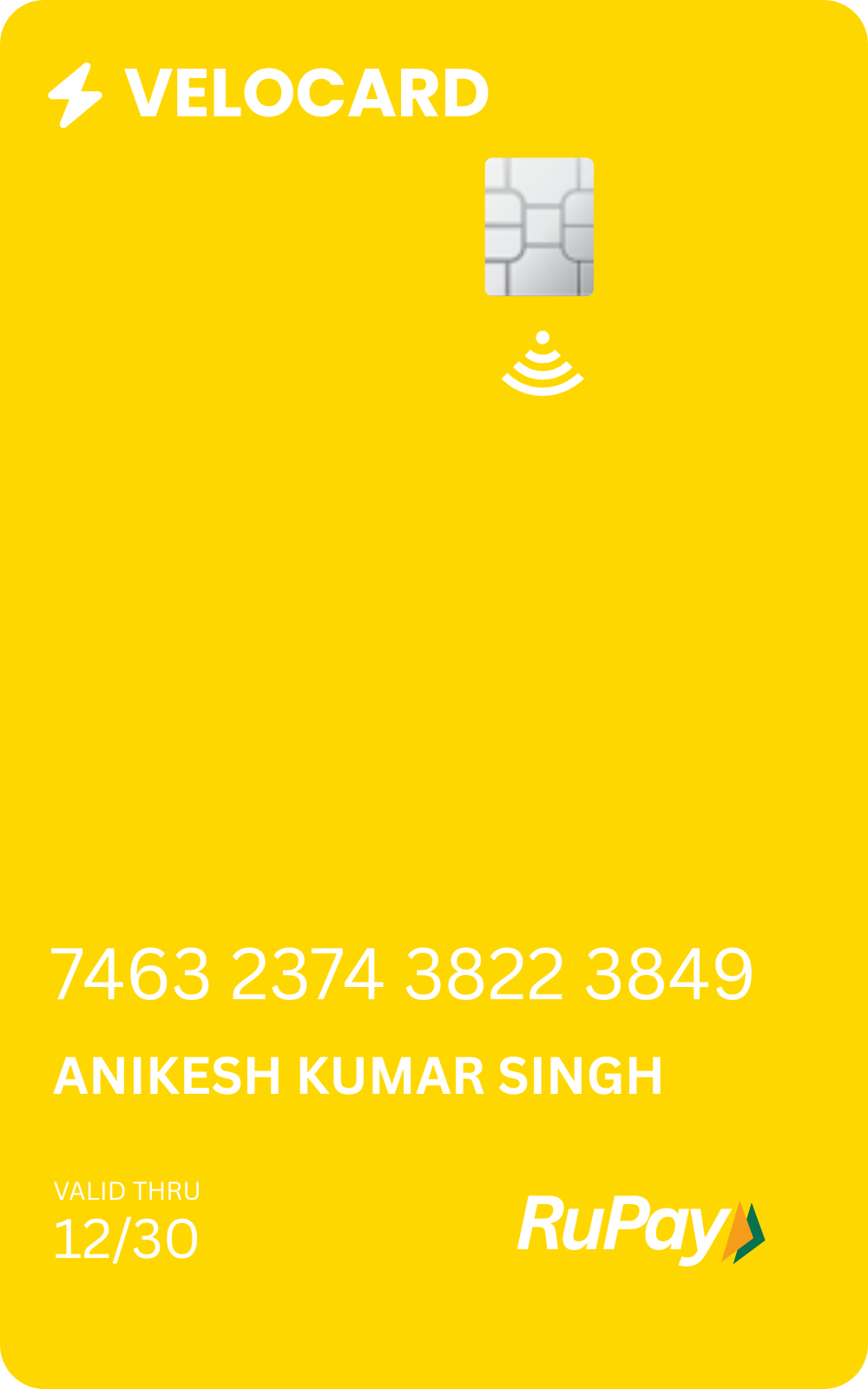

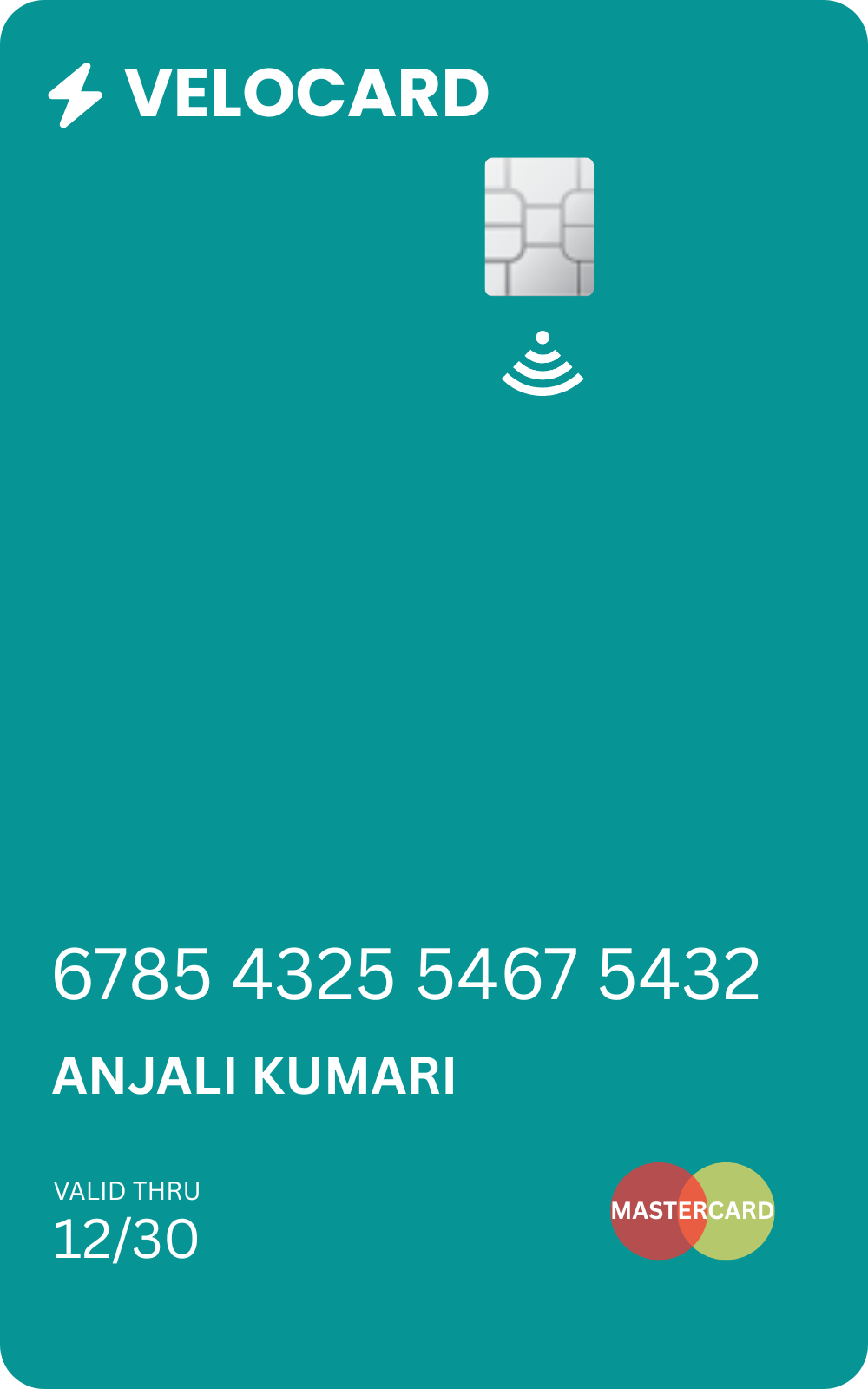

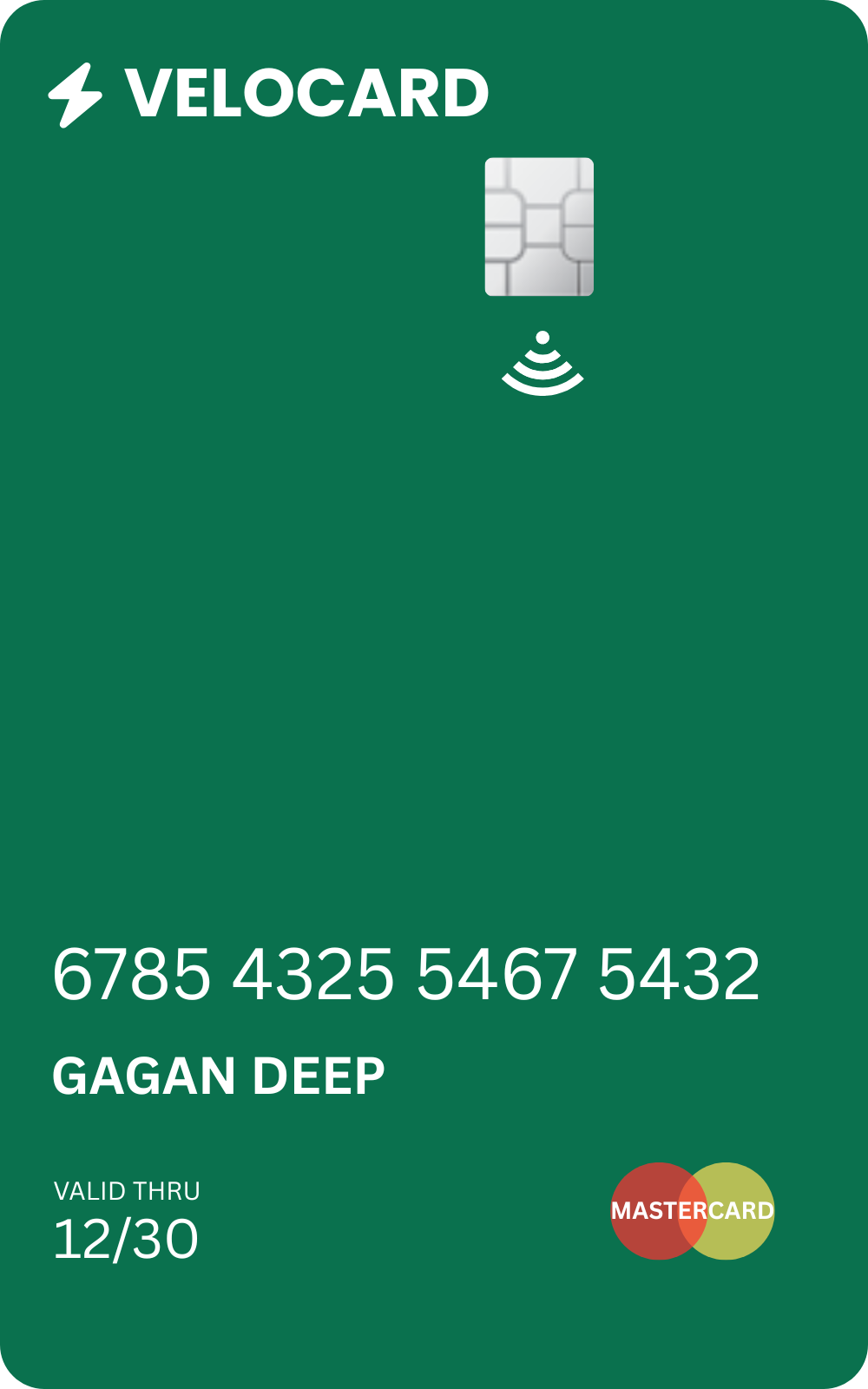

Cards for Every Purpose

Choose from our range of purpose-built cards, each designed with specific features for different lifestyles and needs.

Travel Forex

Premium International Travel Card

- 8+ currencies with zero forex markup

- Global travel insurance included

- Airport lounge access in 100+ countries

- 3X travel points on flights & hotels

- Elite loyalty program tier access

- Virtual + Physical card included

- Tap & pay enabled globally

Perfect for frequent international travelers with exclusive airline and hotel partnerships, premium benefits, and travel rewards.

Travel Domestic

Smart Domestic Travel Card

- Hotel & flight discounts up to 35%

- Instant travel rewards & cashback

- Emergency cash assistance nationwide

- Travel itinerary planning tools

- 2X points on domestic bookings

- Tap & pay across India

- Local experience recommendations

Ideal for domestic explorers with special partnerships across Indian travel providers and travel rewards program.

Shopping Rewards

Ultimate Online Shopping Card

- 5X points on online shopping

- Exclusive e-commerce discounts

- Instant points redemption

- Price protection guarantee

- Virtual card for safe shopping

- Cashback on 1000+ merchants

- Shopping loyalty program

Maximize your shopping experience with premium rewards, exclusive online merchant deals, and shopping points.

Teens (15-21)

Smart Pocket Money Card

- Parental controls & spending limits

- Educational app & course payments

- Financial literacy learning modules

- Savings goals & automated transfers

- Teen loyalty rewards program

- Safe online shopping environment

- Tap & pay with parental approval

Build healthy financial habits early with guided learning, controlled spending, and teen-focused rewards.

Students

Complete Education Card

- Campus fee & bookstore payments

- Educational discounts up to 40%

- Internship stipend management

- Student loan integration

- 2X points on educational purchases

- Student loyalty program

- Credit on UPI for emergencies

Designed specifically for students with special educational partnerships, campus benefits, and learning rewards.

Corporate

Enterprise Expense Management

- Multi-level approval workflows

- Automated GST compliance

- Vendor payment automation

- Corporate loyalty points

- Bulk virtual card issuance

- Tap & pay for employees

- Custom reward programs

Streamline corporate spending with automated reconciliation, detailed reporting, and enterprise-grade card management.

Home Expense

Smart Family Budget Card

- Grocery budget planning tools

- Automated bill payments

- Family spending tracking

- Family loyalty program

- Grocery shopping points

- Tap & pay for quick purchases

- Utility cashback up to 10%

Take control of household finances with intelligent budgeting, family rewards, automated payments, and shopping benefits.

Logistics

Fleet & Transportation Card

- GPS-based fuel payments

- Automated toll payments

- Driver allowance management

- Vehicle maintenance tracking

- Fleet loyalty points

- Tap & pay at fuel stations

- Fleet analytics dashboard

Optimize logistics operations with real-time tracking, automated payment systems, and fleet management rewards.

MSME Business

Complete Business Operations

- Automated salary disbursement

- Dealer & distributor payments

- GST filing & compliance tools

- Business loyalty program

- Credit on UPI for vendors

- Virtual cards for online purchases

- Growth analytics & insights

Empower your business with complete financial management, growth tools, and business-focused rewards.

Loyalty Elite

Premium Lifestyle Card

- Diamond tier loyalty program

- Points never expire

- Premium concierge service

- Exclusive event access

- Metal physical card

- Priority customer support

- 10X points on all purchases

Experience luxury banking with elite status, premium benefits, exclusive lifestyle privileges, and maximum rewards.

Powerful Platform Features

Experience the future of financial management with our comprehensive suite of advanced features.

AI Financial Assistant

Get personalized financial advice, spending predictions, and automated savings recommendations powered by artificial intelligence.

Advanced Security

Military-grade encryption, biometric authentication, real-time fraud monitoring, and instant transaction alerts for complete peace of mind.

Smart Analytics

Visual spending breakdowns, trend analysis, forecasting tools, and customizable financial reports for informed decision-making.

Instant Transfers

Send and receive money instantly with zero fees, 24/7 availability, and seamless integration with all major payment systems.

Automated Workflows

Set up automatic payments, savings rules, investment triggers, and recurring transfers for complete financial automation.

Unified Dashboard

Manage all your finances from one intuitive dashboard with real-time updates, customizable widgets, and multi-device sync.

Financial Education

Access learning modules, investment guides, tax planning resources, and personalized financial literacy programs.

Partner Ecosystem

Exclusive discounts, cashback offers, and special deals from our network of 500+ merchant partners across India.

Comprehensive Benefits

Discover how VELOCARD delivers value across all sectors and user groups.

Travel Points

Earn points on every travel booking, redeemable for flights, hotels, and travel experiences with exclusive partner benefits.

Loyalty Program

Tiered rewards system with exclusive benefits, priority services, and premium perks for frequent users.

Online Shopping Points

Extra points on online purchases across 1000+ partner merchants and e-commerce platforms with special discounts.

Points Redeem

Flexible redemption options including cashback, vouchers, merchandise, travel bookings, and exclusive experiences.

Tap and Pay

Contactless payments with NFC technology for faster, more secure transactions across all payment terminals.

Credit on UPI

Access credit facilities directly through UPI for seamless payments across all merchants with flexible repayment.

Virtual Card

Instant digital cards for online transactions with dynamic CVV for enhanced security and easy management.

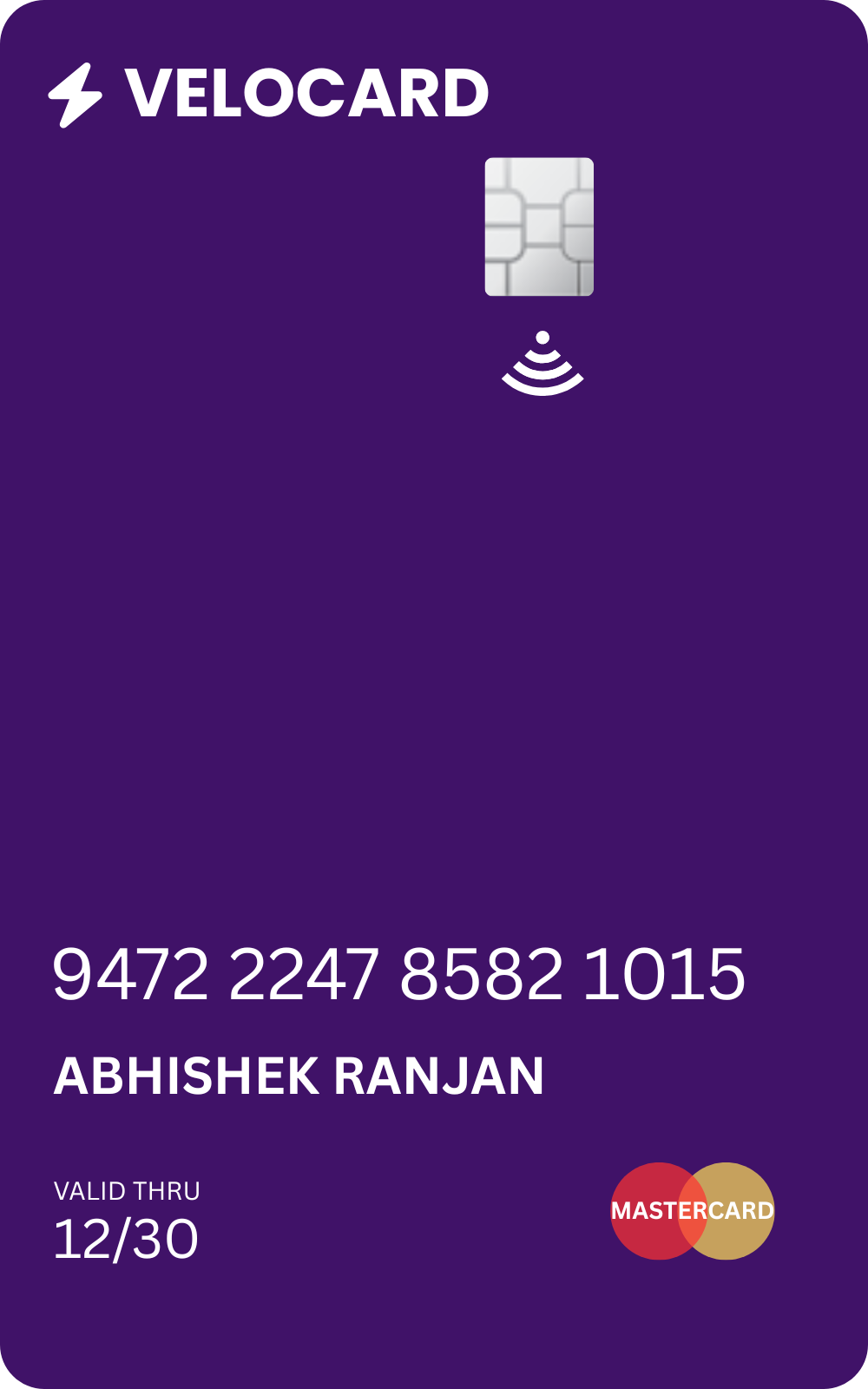

Physical Card

Premium metal cards with custom designs for in-store purchases and ATM withdrawals with enhanced durability.

Financial Control

- Complete spending visibility & analytics

- Automated budget creation & tracking

- Smart savings goals with auto-transfers

- Investment tracking & recommendations

- Tax planning & optimization tools

Security & Protection

- Real-time fraud detection & alerts

- Instant card freezing/unfreezing

- Biometric authentication for all transactions

- Insurance coverage for lost cards

- 24/7 customer support with priority access

Rewards & Benefits

- Cashback on everyday purchases

- Exclusive discounts from partner merchants

- Travel rewards & lounge access

- Health & wellness benefits

- Educational content & financial courses

Educational Support

- Special discounts on educational materials

- Campus fee payment solutions

- Internship & project funding options

- Scholarship & grant management

- Career counseling & placement services

Financial Literacy

- Interactive learning modules

- Budgeting games & challenges

- Investment simulation tools

- Peer comparison & benchmarks

- Certification programs in finance

Community & Growth

- Student entrepreneur support

- Networking events & workshops

- Startup incubation access

- Mentorship programs

- Campus ambassador opportunities

Operational Efficiency

- Automated expense management

- Real-time cash flow monitoring

- Vendor payment automation

- Inventory financing solutions

- Supply chain financing options

Compliance & Reporting

- Automated GST filing & compliance

- TDS calculation & deduction

- Audit trail & documentation

- Financial statement generation

- Tax planning & optimization

Growth Support

- Access to business credit

- Government scheme integration

- Export-import facilitation

- Digital marketing support

- E-commerce integration tools

Enterprise Management

- Multi-department budgeting

- Cross-border payment solutions

- Multi-currency management

- Employee expense automation

- Vendor management portal

Analytics & Insights

- Real-time financial dashboards

- Predictive cash flow analysis

- Department-wise spending analytics

- ROI calculation tools

- Custom report generation

Integration & Automation

- ERP system integration

- Custom API development

- Automated reconciliation

- Workflow automation tools

- Legacy system migration

Transparent Pricing

Clear, competitive pricing for individuals and businesses

Card Activation Fee

Get started with your VELOCARD for just ₹299 one-time activation fee. No hidden charges, no annual fees for the first year.

| Item | Nature of charge | Charges |

|---|---|---|

| Card Activation | One-time activation fee | ₹299 (Limited offer) |

| e KYC (OTP) | Per authentication | ₹10 |

| 3DS Charges | Online transaction security | ₹0.5 per transaction |

| ATM Withdrawal | Per transaction | ₹20 |

| Wallet to Bank Transfer | Transfer charges | ₹4-₹10 based on amount |

| Physical Card | Replacement/Additional | ₹150 per card |

| Virtual Card | Digital card issuance | ₹5 per card |

Custom Corporate Solutions

Issue cards for your entire team with custom limits, centralized controls, and volume-based discounts. Perfect for expense management and employee benefits.

Basic Corporate Pack

Up to 50 employee cards

- Custom card designs

- Centralized dashboard

- Spending limits per card

- Basic reporting

- Virtual cards included

Enterprise Pack

Unlimited employee cards

- All Basic features

- Advanced analytics

- API integration

- Dedicated account manager

- Custom loyalty programs